UCO Bank

Honours Your Trust | |

UCO Bank Head office, BTM Sarani Kolkata | |

| Formerly | United Commercial Bank |

|---|---|

| Company type | Public |

| NSE: UCOBANK BSE: 532505 | |

| ISIN | INE691A01018 |

| Industry | Banking Financial services |

| Founded | 6 January 1943 |

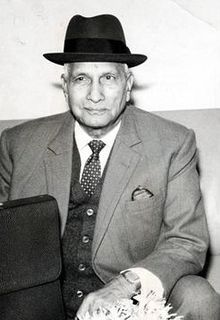

| Founder | G. D. Birla |

| Headquarters | UCO Bank Head Office,

BTM Sarani, Kolkata, , India |

Number of locations | India: 3,230 Branches 2,564 ATMs International: 2 Branches in 2 countries |

Area served | Worldwide |

Key people | Ashwani Kumar[1] (MD & CEO) |

| Products | Consumer banking, corporate banking, finance and insurance, investment banking,mortgage loans, private banking, wealth management |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 21,456 (March 2024)[2] |

| Parent | Ministry of Finance (Government of India (95.39%)) [2] |

| Subsidiaries | Paschim Banga Gramin Bank |

| Capital ratio | 16.98% (2024)[2] |

| Website | https://ucobank.com/en/home |

UCO Bank, formerly United Commercial Bank, is an Indian public sector bank, and financial services statutory body headquartered in Kolkata.[3] UCO Bank is the 10th largest public sector bank in India by total asset and ranked 1948 in Forbes Global 2000 list of year 2018 & ranked 80 on the Fortune India 500 list in 2020.[4] During FY 2023–24, its total business was ₹4.50 lakh crore. The market capitalisation of bank is ₹71,078 crore (2024).

UCO Bank is the only Government of India owned bank in the east India. UCO Bank's headquarter is in BTM Sarani, Kolkata. As of 31 March 2024[update] the bank had 4,000 plus service units & 43 zonal offices spread all over India. It also has two overseas branches in Singapore and Hong Kong.

UCO bank is one of the special bank which facilitates the mechanism of Rupee-Rial and Rupee-Ruble trade of India between Iran & Russia respectively. It become the first bank to open a unique "lockless" branch in Shani Shinganapur in Maharashtra to show the respect to general belief and faith of the people on lord Shani.

History

[edit]

G. D. Birla, an eminent Indian industrialist, during the Quit India movement of 1942, conceived the idea of organising a commercial bank with Indian capital and management, and the United Commercial Bank Limited was incorporated to give shape to that idea. The bank was started with Kolkata as its head office with an issued capital of ₹2 crores, of which ₹1 crore was actually paid up. Birla was its chairman; the Board of Directors included eminent personalities of India drawn from many fields. The bank opened 14 branches simultaneously across India. [citation needed]

After World War II, United Commercial Bank opened several overseas branches. The first, in 1947, was in Rangoon. Branches in Singapore (1951), Hong Kong (March 1952), London (1953), and Malaysia followed. In 1963 the Burmese government nationalized United Commercial Bank's three branches there, which became People's Bank No. 6.[5]

The Bank's Singapore Operations commenced on 21 April 1951 with the opening of the Singapore Main branch and subsequently Serangoon branch was opened in "Little India" on 7 March 1959. The international linkage from Singapore is supported by a large number of Indian branches network through the Integrated Treasury Branch, Mumbai. Other branches in India also provide international banking facilities through Authorised Branches of the bank.[citation needed]

This international network is further augmented by correspondent arrangements with leading Banks at all important world centres in various countries.[6]

On 15 September 1967, Jalpaiguri Banking and Trading Corporation (JBTC) which had been established in Jalpaiguri in 1887 (or 1889; accounts differ), made a voluntary transfer of its assets and liabilities to United Commercial Bank. JBTC had only one office and specialised in lending against mortgages on tea gardens.[7]

The Government of India nationalised United Commercial Bank on 19 July 1969. The nationalised bank continued the operations of the overseas branches in London, Singapore, and Hong Kong. However, Malaysian law forbade foreign government ownership of banks in Malaysia. Therefore, United Commercial Bank (UCO Bank), Indian Overseas Bank, and Indian Bank contributed their operations in Malaysia to a new joint-venture bank incorporated in Malaysia, United Asian Bank with each of the three parent banks owning a third of the shares. At the time, Indian Bank had three branches, and Indian Overseas Bank and United Commercial Bank had eight between them.[8]

To keep pace with the developing scenario and expansion of business, the Bank undertook an exercise in organisational restructuring in the year 1972. This resulted in more functional specialisation, decentralisation of administration and emphasis on the development of personnel skills and attitudes. Side by side, whole-hearted commitment to the government's poverty alleviation programmes continued and the convenorship of the State Level Bankers' Committee (SLBC) was entrusted to the Bank for Odisha and Himachal Pradesh in 1983.[citation needed]

An act of parliament changed the bank's name to UCO Bank in 1985, as a bank in Bangladesh existed with the name United Commercial Bank PLC, which caused confusion in the international banking arena.[9]

In 1991, Bank of Commerce acquired United Asian Bank; in time CIMB came to own Bank of Commerce.[citation needed]

In 1998, UCO closed its London branch. Bank of Baroda acquired the assets and liabilities, but not the personnel, who were made redundant.[citation needed]

Current market position

[edit]As on 31 March 2024, government share-holding in the bank was 95.39%. For FY 2023–24, it registered ₹1,653.74 crore net profit with global business of the Bank stood at Rs. 4,50,007 crore as compared to Rs. 4,10,967 crore showing an increase of 9.50% over March 2023.

Domestic Presence

[edit]The Bank's Regional presence includes 3,230 branches excluding 2 Foreign branches and 2,564 ATMs as in March 2024.

The domestic branches include 6 Flagship corporate branches, 7 Asset Management branches, 4 service branches, 1 central pension processing center and 1 integrated treasury branch. Further 25 MCU branches, 39 Retail loan Hubs, 28 Agriculture Loan Hubs, 21 SME Hub and 72 currency chests are also functioning across the country attached to the major city branches of various centres.

International presence

[edit]Besides providing inland banking services through its vast network of branches in India, UCO Bank has a vital presence in the financial markets outside India. UCO Bank presently has 2 overseas branches (one each in Singapore and HongKong) and 1 representative office has been established in Tehran, Iran.

Zonal Offices & Regional Training Centres

[edit]Board of directors

[edit]As of August 2023, the UCO Bank Board of Directors has nine members:[10]

- Shri Shri Ashwani Kumar (MD & CEO)

- Shri Rajendra Kumar Saboo (executive director)

- Shri Vijaykumar Nivrutti Kamble (executive director)

- Dr Sanjay Kumar (Director)

- Shri Rajesh Kumar (Director)

- Shri Anjan Talukdar (Director)

- Shri Ravi Kumar Agrawal (Director)

- Shri Subhash Shankar Malik (Director)

- Shri K. Rajivan Nair (Director under Shareholder Category)

Regional management

[edit]The governance of the Bank all around the nation's respective regional areas is managed by a network of 43 Zonal Offices. These are present in major as well as crucial parts of the country.[11]

Training

[edit]The training of newly recruited as well as present staff is overseen by seven training colleges around India:[12]

- Central Staff College, Kolkata

- Regional Training Centre, Ahmedabad

- Regional Training Centre, Bhubaneswar

- Regional Training Centre, Bhopal

- Regional Training Centre, Chandigarh

- Regional Training Centre, Chennai

- Regional Training Centre, Jaipur

Subsidiaries

[edit]Paschim Banga Gramin Bank a Regional Rural Bank of West Bengal is the subsidiary of UCO Bank with 35% stake.

The bank has requested the RBI for an approval for new Non-Banking entities under its command. The new entities would ensure a complete market foothold.[13]

Logo and motto

[edit]- The logo of UCO bank consists of a pair of clasped hands covered with an octagonal structure. It has been coloured blue since the organisation's inception, blue representing the Bank's national responsibility. The background has remained yellow since the beginning as well.

- The motto of UCO Bank is "Honours your Trust".[14]

- The UCO bank Logo has resemblance to logo of leading South African Life Insurance company Sanlam. Sanlam has tie up with Shriram Group in India who provide Insurance to passengers travelling in Indian Railways[citation needed]

See also

[edit]- Banking in India

- List of banks in India

- Reserve Bank of India

- Indian Financial System Code

- List of largest banks

- List of companies of India

- Make in India

Citations and references

[edit]Citations

- ^ Chakraborty, Dwip Narayan. "UCO Bank-এর ম্যানেজিং ডিরেক্টর এবং CEO পদে নিযুক্ত হলেন অশ্বনী কুমার". Bengal Xpress (in Bengali). Retrieved 3 June 2023.

- ^ a b c d e f g h "Annual Report of UCO Bank" (PDF).

- ^ "India's Most Trusted Brands 2013". Archived from the original on 28 August 2013.

- ^ "India's Most Trusted Brands 2014". Archived from the original on 2 May 2015.

- ^ Turnell (2009), p.226.

- ^ "OfficialWebsite". ucobank.com. Retrieved 27 February 2013.

- ^ Basu (1939), p. 140.

- ^ Lee (1990), p. 50.

- ^ Bandyopadhyay (2016).

- ^ "OfficialWebsite". ucobank.com. Retrieved 17 December 2023.

- ^ "Departments". ucobank.com. Retrieved 27 February 2013.

- ^ "Names of Training Centres with their Email IDs". ucobank.com. Retrieved 27 February 2013.

- ^ "UCO Bank to open its Financial Subsidiary". rupeetimes.com. Retrieved 27 February 2013.

- ^ "Slogan of UCO Bank". slogandb.com. Retrieved 27 February 2013.

References

- Bandyopadhyay, Tamal (2016). Bandhan: The Making of a Bank. Random House India.

- Basu, Saroj Kumar (1939). Industrial Finance in India: A Study in Investment Banking and State-aid to Industry with Special Reference to India. University of Calcutta.

- Lee, Sheng-Yi (1990). The Monetary and Banking Development of Singapore and Malaysia. NUS Press.

- Turnell, Sean (2009) Fiery Dragons: Banks, Moneylenders and Microfinance in Burma. (NAIS Press). ISBN 9788776940409